Summary

December quarter Consumer Price Index (CPI) annual inflation came in at 2.2%, consolidating near the middle of the Reserve Bank’s 1-3% target band. The outcome was marginally higher than Reserve Bank and market consensus expectations.

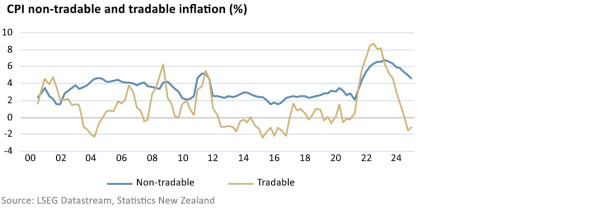

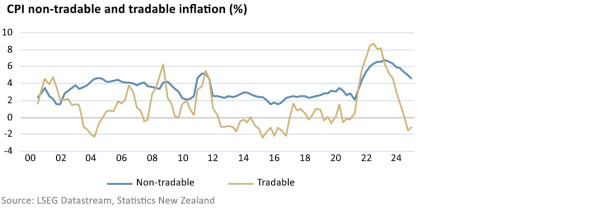

Sharply declining tradeable goods price inflation has been the dominant subduing factor on the annual inflation rate, although non-tradeable goods and services inflation has also gradually waned. Measures of underlying inflation also eased.

While headline inflation was marginally higher than the Reserve Bank expected it will be encouraged by lower-than-expected non-tradeable inflation. Therefore, we expect the Reserve Bank will further cut the Official Cash Rate by 0.5% to 3.75% when it meets next month.

Inflation has consolidated in the Reserve Bank’s target band

December quarter Consumer Price Index (CPI) inflation came in at 0.5% for the quarter and 2.2% on an annual basis, consolidating within the Reserve Bank’s 1-3% target band. The annual inflation outcome was marginally higher than the 2.1% expectations of the Reserve Bank and market consensus.

The quarterly and annual inflation rates have been subdued the most by declines in tradeable prices as global supply chains continue to heal and global demand for goods cool post-pandemic. A recovery in local produce

supply after damaging floods in 2024 has also helped subdue fresh food prices. While tradeable goods inflation was muted, it was stronger than expected in the December quarter largely due to a spike in international

airfares.

Annual non-tradeable inflation is typically the stickier of the two broad components of CPI inflation, and there have been past concerns domestically sourced inflation pressures could stall progress towards the Reserve Bank’s inflation target. However, key non-tradeable inflation components such as residential rents and insurance continued to gradually fade in the December quarter giving hope underlying inflation pressures are

being sustainably subdued.

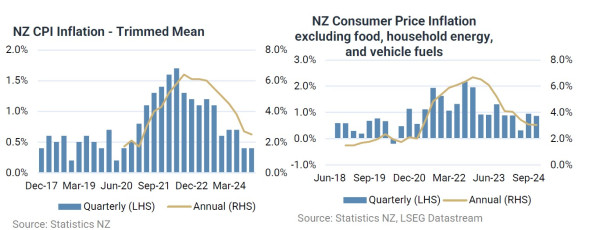

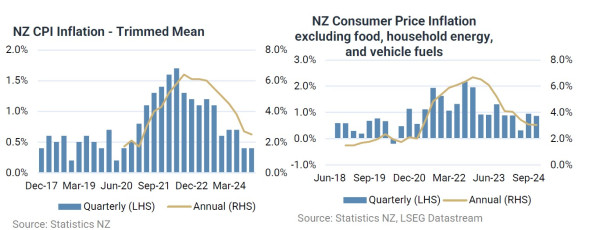

Measures of underlying inflation pressures also show a gradual descent in the December quarter, with 30 percent trimmed mean annual inflation declining to 2.5% from 2.7% in the September quarter. CPI inflation excluding food, household energy, and vehicle fuels edged down to 3.0% from 3.1% the previous quarter.

Another 0.5% OCR cut likely in February

While the December quarter headline inflation rate was slightly higher than the Reserve Bank expected in its November Monetary Policy Statement (2.2% versus 2.1% expected), the composition of the drivers of the forecast miss would have been encouraging. Notably, annual non-tradable inflation was lower than the Reserve Bank expected (4.5% versus 4.7% expected).

Therefore, with signs the New Zealand economy remains stuck in the mire and inflation clearly heading down, the Reserve Bank is likely to cut the OCR by another 0.5% to 3.75% at its next meeting on 19 February. This would be consistent with hints by Governor Adrian Orr at the Reserve Bank’s November meeting.

More conclusive evidence for further chunky OCR cuts is likely to come on 5 February with the release of December quarter labour market statistics, which is likely to indicate a further rise in the employment rate.

The OCR remains restrictive and likely needs to decline to 3% or below before it starts to meaningfully stimulate the local economy and stop inflation falling to the bottom half of the inflation target band. Therefore, we expect the Reserve Bank to steadily cut the OCR over 2025 to around 3% or slightly under.

John Carran is Director, Investment Strategist and Economist, Wealth Research. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Wealth Limited is an NZX Advisory Firm. A financial advice provider disclosure statement is available free of charge here.